The Cash App makes it possible that you can basically receive an unlimited quantity of in-App Purchases for Cash App within just with 3 minutes of time and very little effort at almost all.

- How To Send Money Cash App Thats Not Real

- How To Send Money Cash App Thats Not Really

- How To Send Money Cash App Thats Not Really

The Cash App Cheat is completely unengaged to use and you’ll generate as much in-App Purchases when you desire. If you want to receive more in-App Purchases for Cash App while using Cash App hack Tool then feel free to simply use the Cash App Cheats again.

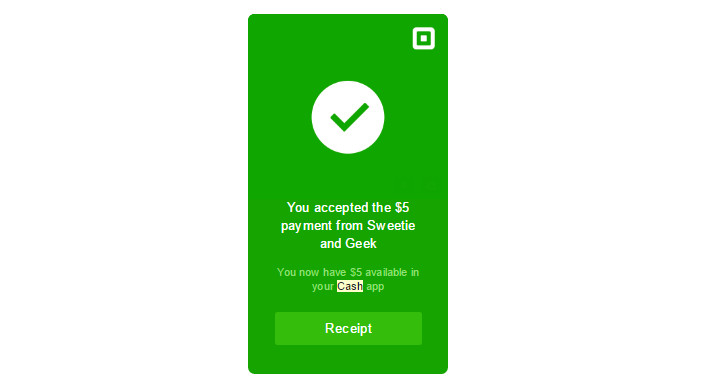

The Cash App makes it possible that you can basically receive an unlimited quantity of in-App Purchases for Cash App within just with 3 minutes of time and very little effort at almost all. The Cash App Cheat is completely unengaged to use and you’ll generate as much in-App Purchases when you desire. If you want to receive more in-App Purchases for Cash App while using Cash App hack Tool. There are apps such as Venmo, PayPal, Superpay and many more where you can send and receive money with ease. But with 36 million active users, Cash App is a popular choice. Cash App is a mobile peer payment service that allows users in the same country, or between the US and the UK, to transfer money to one another. After doing some extensive research, I ranked and reviewed the best money making apps to earn fast cash this year. These rankings cover different types of money making apps: iPhone apps where you perform simple tasks for free money. Money-saving apps that help you save money. Personal finance apps for automated investing and passive income.

Always follow the instructions with all the Cash App rules to make sure that every works out fine and you may receive your totally free in-App Purchases.

You don't have to pay a single bucks, this is totally free of cost. You have not to waste time for downloading any software peculiar.

The Hack Tool for Cash App also work for Android, iOS and Facebook which you decide on before using the generator and follow the instructions.

It's clear that you have a lot of advantages in the game by using the Cash App Hack Tools. Many of the regular gamers get their resources from our Cash App Cheat here.

There is not a huge secret behind the usage of this Hack Tool and most users is doing so. You will finally dominate in every situation you are able to reach inside the game and compete with all the pro gamers.

The only thing you have to do is use our online generator. This generator saves you a lot of time as well as money. Thanks to the team of developers & hackers who managed to find some loopholes & exploit the server of Cash App.

Does anyone carry cash anymore?

A recent study estimated 79 million adult Americans will use peer-to-peer payment services in 2019. This is an increase of 24 percent over last year, according to eMarketer, a market research company.

Why?

Because it’s never been easier, cheaper, and more efficient to send money online. Thanks to tons of free apps and minimal fees (if any!), these apps make it much easier than going to the bank to get cash.

Plus, it’s never been safer as companies make a huge effort and spend millions of dollars to protect your financial identity online. The best part though, is the convenience.

You don’t need to go to the bank’s ATM, try to avoid fees, break change at dinner, and worry about not having cash anymore.

12 Best Send Money Apps

Here’s everything you need to know about the best ways to send money, how to send it internationally, and some other best practices.

1. Apple Pay

Apple Pay may be the simplest way to send money if you use an iOS device.

Before you get started, you will need to add your debit card to your iOS device. You can quickly access those settings by going to Settings and then scrolling down to Wallet & Apple Pay inside any iOS device.

| Sending or Receiving Money | Apple Pay | ||

|---|---|---|

| Apple Pay Send and Receive Limits | Minimum | Maximum |

| 7-day period | $1 | $10,000 |

| Per message | $1 | $10,000 |

To request payment or send payment, simply create a text message for the person you are paying or requesting money from. Inside your text messages and right above the keyboard is a series of icons to choose from. Click on the one that has the Apple Pay logo. If you’re sending payment, you will need to enter in your password (fingerprint or retina scan) and the money will be sent instantly.

Note: This will only work with iOS devices.

2. Venmo

Venmo is a money transfer app that is actually owned by PayPal but operated separately. It’s more of a social sharing and payment platform than PayPal. This is my personal preferred method of sending money online.

One of the biggest perks is that it is 100% free if you send money from a bank account. If you choose to add a credit card and transfer money, there is a small fee as they have to deal with credit card processing fees. These fees are around 3% if you opt to use a credit or debit card.

All you need to send money is to make sure that both people download the app. Once you select an amount, type in what it’s for and push send.

| Venmo Limits | |

|---|---|

| Sending/Receiving money to Venmo users | $2,999.99 weekly limit |

| Sending/Receiving money authorized merchants | $2,000 per purchase (max 30 per day) |

| $299.99 max for first-time users | |

The money will arrive instantly and can be transferred to your bank account within 2-3 business days. Plus, if you don’t have your app you can also pay with Venmo from their website.

Venmo is more of a social app than the others as you can see who is sending who money. But don’t worry, the amount of money you send isn’t displayed. If you don’t want others to see your activity make sure to log on to your profile and change these settings.

3. Google Wallet

Google Wallet is a very simple way to send money as the other person doesn’t even need to download the app. To get started sending money, log into your app and add your debit card or bank account information.

All you need is the email address or phone number to use the app to send money. As long as they have a Google account with a linked bank account or debit card, the other user can withdraw the funds. The max amount is $9,999 per transfer or $50,000 over a 5-day period.

| Google Play Limits | |

|---|---|

| Single Transaction | Up to $10,000 |

| In 7 days | UP to $10,000 |

| Florida residents | Up to $3,000 every 24 hours |

| Transactions over $2,500 | Recipient will need to add a bank account to claim the money |

A big plus with using Google Wallet is the amount of security you receive. As Google is one of the largest companies in the world, the security matches. Plus, if you somehow lose your phone you can disable and have the app removed from your phone from logging in online.

But, a major downside is that you aren’t able to pay using a credit card. Also, the bank transfers can up to 10 days!

4. Facebook Messenger

In Facebook’s attempt to take over the world, you can now use the social media sharing platform to transfer money not just mindlessly scroll through your newsfeed. They make it very simple to send money via the Messenger app.

All you need to do is download the app (if you haven’t already) and find the person you want to send money too. Hit the “$” sign in the chat and enter your debit card to complete the transaction. Once the other user receives the money they will also need to add a debit card to withdraw the funds.

As Facebook is worldwide, I was surprised to learn that you can only use this app to send money if you are both located in the United States. If you’re worried about safety, Facebook does allow you to add a pin and extra verifications once you add your debit card. The entire transfer process takes 1-3 business days.

Even though it’s a social media app don’t worry, your payment details aren’t displayed anywhere on your profile.

Note: Facebook messenger limits vary from country to country.

5. Square Cash

Square Cash is another app that allows you to send money to family and friends 100% free. You can use the app in two different ways. If the other person has a Square Cash account you can ask for their “cash tag” and do a money transfer. If you don’t have an account you can still pay by iMessage and Siri as well.

When you transfer money with Square Cash there is a service limit of $250 per week. But, if you go through the short verification you can increase your limit to $2,500!

| Square Cash Limits | |

|---|---|

| Send money | $250 per week |

| Recieve money | $1,000 per week |

| Increase send limits up to $2,500 when you verify your account | |

The only real downside to using square cash is that you can’t use the service if you are outside the United States. Otherwise, it’s a very comparative payment option to Venmo.

If you run a business and want to use Square Cash they also have several options that allow you to use the app for payments.

6. Dwolla

Dwolla is a money sending app that allows you to transfer money from your bank account to others for a nominal fee. If the transfer is under $10 you won’t have any service fees and anything over is only .25 cents!

The max amount of money you can send from Dwolla is $5,000 for personal accounts and up to $10,000 for business accounts. All you need is the Dwolla ID of the other person/business, email, and phone number. If the other person doesn’t have an account yet it will prompt them to sign up for free.

| Dwolla Limits | |

|---|---|

| Personal Account | Send up to $5,000 per transaction |

| Business, Non-profit, and Government Accounts | Send up to $10,000 per transaction |

| You can apply for increased limits anytime. Approval is based on Dwolla's discretion. | |

Like Square Cash, Dwolla also has several business options to help you send money at a very minimal cost. You can receive higher limits, next day transfers, and better customer support. This is the best money sending app if you are wanting to use a money sending app for your business as well.

7. Zelle

Zelle is a great app to send money but you need to have an account with participating banks or signing up at clearxchange.com. They are becoming increasingly popular with the bigger banks joining clearxchange.

There are currently over 400 banking partners with Zelle.

Here are a few of the bigger participating banks:

How To Send Money Cash App Thats Not Real

- Chase Bank

- Wells Fargo

- U.S. Bank

- Capital One

- Ally Bank

- Bank of America

To send money all you will need is the recipient’s email or phone number. Check with your bank to learn how to sign up for Zelle today or register at clearxchange.com.

Note: Limits to send money via Zelle are created by your own bank or credit union. If you use Zelle outside of your bank, the send limit is $500 per week.

8. Popmoney

While not as common as the other apps above, Popmoney is another app that lets you send money online. Popmoney has partnered with numerous banks and credit unions to send and request money from your mobile banking app.

Here are the current limits for Popmoney:

| Popmoney Send Limits | |||

|---|---|---|---|

| From your | Fee (free to receive) | Limit per day | Limit 30 days |

| Bank Account | $0.95 | $2,000 | $5,000 |

| Debit Card | $0.95 | $500 | $1,000 |

| Pop Money Receive Limits | |||

|---|---|---|---|

| Request Money | Fee (free to receive) | Limit per day | Limit 30 days |

| Pay a request | Free | $2,500 | $4,000 |

| Send a request | $0.95 | $1,000 | $2,500 |

You can send money to someone else who has Popmoney for free. Otherwise, it is only .95 cents to transfer the money.

9. PayPal

PayPal is one of the oldest and first apps to help send money both domestically and internationally as they are the preferred method of payment for eBay before being acquired by them.

If you have a personal PayPal account you can send money free as long as the other person has a personal account. While you can transfer from a business account, there a few more steps to open the account and transaction fees as well.

To send money, log on to the app or website and make sure you have the intended recipients phone number or email address. You can choose to send the money from your bank, debit card, or credit cards. If you use a PayPal balance or your bank account there are no transaction costs.

But if you choose to use a credit or debit card there is a 2.9% fee plus 30 cents. The fees are even higher when sending money abroad. Two major perks are the security and total amount (up to $10,000) to send money.

Plus, PayPal is on the send money apps on the list that allows you to send money internationally. Below are the most common ways to send money outside the United States.

Note: There is no limits on sending or receiving money via Paypal with a verified account (linking your bank account or credit card).

10. Walmart 2 Walmart Transfers

Walmart is a great place to shop and save money each month for your budget. Now you can also send cash! This is a cheaper option than using Western Union or Moneygram. Plus, it’s convenient as you might already be shopping there on a regular basis.

You can use their transfer service to send to other Walmart’s around the country. The maximum amount you can transfer is $2,500 and costs vary depending on transfer amount.

A potential downside is that not every Walmart does offer the transfer service although a majority do. Make sure to check their website to ensure your Walmart does offer the money sending service.

11. Cash

If you’re old-fashioned or sell some stuff as a side hustle and have extra cash, you can still pay the old school way. While I’ll never recommend sending cash in the mail, it’s still an option. If you do, make sure that the postage is insured just in case!

Otherwise, I recommending switching to one of these send money apps to increase your security and not waste time finding the closest ATM.

12. Bank Transfers

While it’s not an app like most of the others on this list, you can still use old-fashioned bank transfers to send money to friends or family if you have the same bank. If they bank at a different establishment there is almost always a transfer fee which can range depending on institutions and overall amount.

Transaction fees are the main reason I don’t recommend using bank transfer to send money as you can avoid it with most of these apps.

8 Ways to Send Money Internationally

The methods above making sending money easy, but when it comes to sending money internationally it’s not always as simple but still easier than it ever has been. It is more difficult because of higher regulations, fraud, and different banking operations.

Here are the best and cheapest ways to send money internationally.

1. PayPal

As I mentioned, PayPal is one of the most secure and best ways to send money online. When you use a bank account there is a very small processing fee and a higher fee if you choose to use a credit card as the form of payment.

Depending on where you are located it might even be cheaper to use a credit card instead of a bank account. Make sure to compare both before hitting send.

PayPal is very easy and very secure as it’s payment giant. But, there are some restrictions that don’t make it always the best experience. Depending on location and verification you can only send limited amounts of money.

If you try to do more or PayPal thinks it’s fraud, they can freeze your account and make it difficult to reopen. Usually, you will have to contact a call center and go through additional verification steps before sending money.

2. TransferWise

TransferWise is a U.K. company that allows you to send money internationally to select countries. The best part is that the fees are minimal and you only pay the actual exchange rates. Plus, the daily amounts are incredibly high compared with other platforms!

There is a $50,000 daily limit and $250,000 annually. If you do business internationally this is also a great option as you can send $250,000 daily and $1 million per year!

If you want to start download their mobile app today.

3. Western Union

Western Union has been a way to send money internationally for decades and is the biggest money transfer company in the world. To send money you can go into one of their locations internationally, use their app or their website.

You can choose to use cash or a debit card to fund the money transfer and can be direct deposited or picked up by the recipient at a Western Union location. The delivery options make this one of the biggest perks along with low fees and a very small exchange rate markup.

The biggest downside of using Western Union is the costs and delivery time. The cheaper the transfer usually the longer it will take to be delivered.

4. OFX

OFX is very similar to Transferwise and doesn’t charge fees regardless of how much money you are sending! They make their money by taking a cut on the exchange rate for transfers.

They are also great if you are transferring a large sum of money as the minimum amount to transfer is $1,000. This is relatively high as others on the list have a minimum between $50-$100.

Another perk of using OFX to send money internationally is that you get a discount the more you use the service. If you are sending money abroad on a regular basis, this can help save you tons of money over time. Unlike Transferwise, they do not have daily limits and have incredible 24-hour support if you are having any issues.

Get started with OFX today!

5. MoneyGram

MoneyGram is a large money sending platform that operates in over 200 countries and has 350,000 locations! They are the biggest competitor of Western Union and offer the ability to send money to other locations and have the money picked up almost instantly.

What’s the catch with using Moneygram?

The fees.

If you send between $200 and $1,000 the costs will range from $10-$25 and exchange rates can make it even worse. The average exchange rate adds another 1-6% on your transaction fees. This can add up if you are regularly sending money abroad!

6. Xoom

Xoom is the sister app of Venmo and also owned by PayPal. Think of them as the Venmo abroad.

While Xoom doesn’t service as many countries as Western Union or Moneygram, it does makeup in how fast the transfers happen. They still operate in 70 countries and allow you to send up to $25,000 to some countries.

You can choose to pay with credit card, debit card, or bank account and most transfers happen instantly.

The biggest downside?

High costs when using your debit or credit card. Depending on where you are located it can be a substantial amount.

If both parties are using bank accounts this is one of your best options! Make sure to check out their free online calculator to help you evaluate the fees before sending money abroad.

7. Wire Transfer With Your Bank

One of the easiest but not cheapest ways to send money online is a traditional wire transfer. You will have to deal with bank fees and depending on the bank, an exchange rate markup. The transaction can take a few days due to banking regulations and where the money is being transferred.

If you are transferring a large amount of money this is the option I would recommend. While it is more expensive it’s also much more secure.

Most Frequently Asked Questions About Sending Money Apps

Here are some of the most commonly asked questions to help ease your financial concerns about sending money online.

How long will my transfers take to complete?

It depends on each of the apps and providers. Some will help you send or receive money faster than others. Generally, it will be between 1-3 business days while some take closer to 3-5 days. Remember that if you transfer money on a weekend or holiday it will take longer to complete the transaction due to banking regulations.

Is this safe to transfer money through an app?

Yes, security is a major concern. Like anything online, there is always a small risk but these companies spend millions on advanced software and highly qualified engineers to ensure you are protected.

That being said, make sure to review your bank accounts and app usage to ensure there isn’t any charges you don’t recognize.

What are the main types of fees with these apps?

There are two main fees associated with sending money through apps or bank transfers. The first is the transfer fee which can be a percentage of the total amount, flat fee or a combination of both like PayPal.

The other fee is the exchange rate markup that only occurs if you are sending money internationally. These fees will differ from each app and depend a lot on the currency you are using.

Some companies, like OFX, don’t charge transfer fees but instead take a cut of the exchange rate markup. Make sure to double check these fees as different countries have very different costs associated with them.

Final Thoughts on Best Sending Money Apps

As you can see, it’s never been cheaper and easier to send money to friends and family. Domestically there are plenty of options. I personally love Venmo but after researching this post other top recommendations include Apple Pay, Google Wallet, Zelle and PayPal. If you want to send money domestically and prefer a brick and mortar go with Western Union, Moneygram or Walmart.

When it comes to sending money internationally this might require a little more research on your end as fees can vary between different companies. My biggest piece of advice is to use the one that is the cheapest by making sure you are shopping around.

Lastly, try not to use credit cards for sending money as most of these charge higher fees than a debit card or bank account. Any extra money you can save the better!

How To Send Money Cash App Thats Not Really

What is your favorite sending money app for friends and families? Have you ever send money internationally with an app or were you worried about security?

How To Send Money Cash App Thats Not Really

Let us know in the comments!