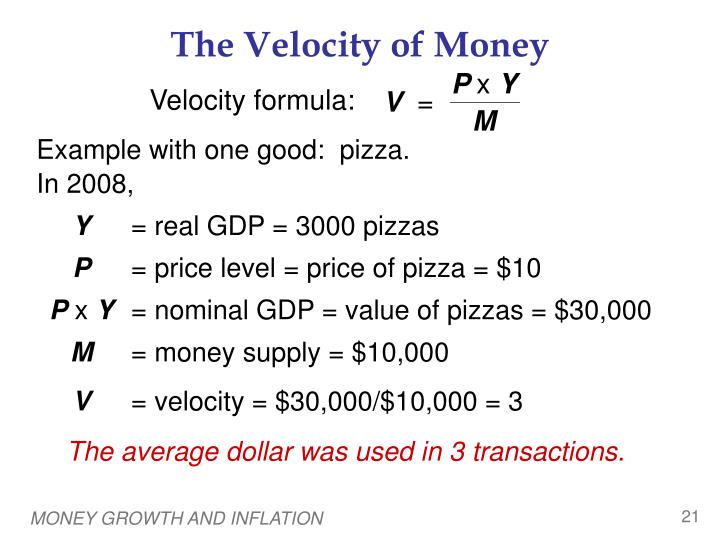

Velocity of Money Calculation. To Calculate the Velocity of Money you simply divide Gross Domestic Product (GDP) which is the total of everything sold in the country by the Money Supply. Thus Velocity of Money= GDP ÷ Money Supply. Now there is some debate about the proper measurement of the money supply. GDP Formula Gross Domestic Product (GDP) is the monetary value, in local currency, of all final economic goods and services produced in a country during a. Equation is as follows: Gross Domestic Product (GDP) = Money Supply x Velocity of Circulation. Therefore, the formula for velocity is the following.

- Price Real Gdp Money Supply Velocity Calculator

- Price Real Gdp Money Supply Velocity Formula

- Money Supply Fred

The relationship between money supply and price level lies in the fact that the amount of money in circulation in an economy has a direct impact on the aggregate price level. This is mainly because an abundance of money leads to an increase in demand for goods and services, while a scarcity of money has the opposite effect. In economic terms, this effect is explained by the quantity theory of money, which states that the amount of money in supply in an economy has a direct bearing on the price level.

A simple way of looking at the relationship between money supply and price level is to consider the fact that consumers will only spend when they have something to spend. That is to say that when there is a lot of money in the economy, people will have more to spend. This increase in demand also causes a corresponding increase in the price level. Excess liquidity leads to a situation in which a lot of cash will be vying for an often limited supply of goods. This causes the money to gradually lose its value, which consequently leads to price increases.

Economists rely on the relationship between money supply and price level as one of the indicators of the state of the economy. When there is a rise in the aggregate price, one of the chief factors responsible is too much demand caused by consumers having easy access to money. The response of the government to this is often to introduce monetary or fiscal policies meant to restrict the ease with which consumers can obtain money, including bank loans and various types of credit. One method by which the government can restrict access to money is through increases in general interest rates.

The effect of this restriction further illustrates the relationship between money supply and price level, because this maneuver usually forces the price level to drop. When the central bank of a country increases the interest rate, consumers may find the conditions attached to obtaining money to be either too prohibitively expensive or too rigorous, as other banks tighten their lending policies in response to the interest rates increase. As a consequence of the lack of easy access to funds, consumers tend to become more conservative in their spending habits, leading to a drop in the demand for goods and services. The consequence of a reduction in demand is an accompanying drop in the prices of goods and services.

Interpretation

The 'M2 Money Supply', also referred to as 'M2 Money Stock', is a measure for the amount of currency in circulation. M2 includes M1 (physical cash and checkable deposits) as well as 'less liquid money', such as saving bank accounts. The chart above plots the yearly M2 Growth Rate and the Inflation Rate, which is defined as the yearly change in the Consumer Price Index (CPI). When inflation is high, prices for goods and services rise and thus the purchasing power per unit of currency decreases.

Historically, M2 has grown along with the economy (see in the chart below). However, it has also grown along with Federal Debt to GDP during wars and recessions. In most recent history, M2 growth surpassed 10 percent in the crisis of 2001 and 2009, during which an expansionary monetary policy was deployed by the central bank, including large scale asset purchases.

According to Bannister and Forward (2002, page 28), Money supply growth and inflation are inexorably linked.

Data Sources

- M2 Money Stock

- Federal Reserve Bank of St. Louis: M2 Money Stock since 1959

- United States Census Bureau: Historical Statistics of the United States, Colonial Times to 1970 (M2 Money Stock until 1959, Chapter X, pages 992-993). Following Bannister and Forward (page 28), M2 prior to 1959 is calculated by adding 'Currency held by the public' + 'Deposits adjusted, commercial banks' + 'Bank vault cash' + 'Monetary gold stock' + 'Deposits at nonbank thrift institutions'

- Inflation

- Federal Reserve Bank of St. Louis: CPI since 1913

- Robert Shiller Online Data: CPI from 1871 until 1913

- US Gross Domestic Product

- Federal Reserve Bank of St. Louis: US Gross Domestic Product

- Congressional Budget Office: Historical Gross Domestic Product

Price Real Gdp Money Supply Velocity Calculator

Price Real Gdp Money Supply Velocity Formula

Further Information

Money Supply Fred

- Investopedia: What is M2?

- Investopedia: What is Inflation?